Bijzonder

lage rente voor hypotheken heeft in de VS niet kunnen voorkomen dat

de huizenmarkt verder onderuitzakt. Vooral in de

dichtbevolkte binnensteden met daaromheen veel minder dicht bevolkte

buitenwijken, gebieden waar nog volop werkgelegenheid is te vinden,

komt de klad in de huizenverkoop......

Tegelijk

neemt het aantal achtergelaten huizen toe, dus waar de bewoners niet

langer de kosten op kunnen brengen voor hun veel te dure huis, ofwel

het gaat hier vooral over hypotheken die 'onder water staan...'

In het

volgende artikel van Zero Hedge 50 voorbeelden van

gebieden waar de boel vast lijkt te lopen, terwijl vreemd genoeg de

huizenprijzen dalen in die gebieden, iets dergelijks gebeurde ook

voordat de crisis in 2008 in volle hevigheid losbarstte......

Destijds wist men in de VS slechte hypotheken te slijten aan vooral

Europese banken, wat voor veel van die banken de doodsklap was geweest, ware het

niet dat de burgers werden gedwongen op te draaien voor de verliezen

die het veel te hoog betaalde schoftentuig van banken hadden gemaakt, ofwel om de banken

te redden van faillissement......*

Here

Are The 50 US Housing Markets Already Turning Ugly

Mon,

12/23/2019 - 22:05

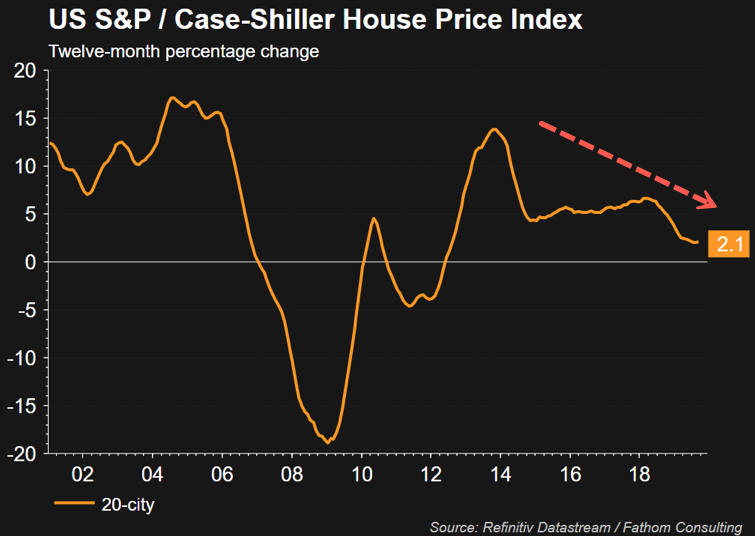

Plunging

mortgage rates in late 2018 through 2019 wasn't enough to revive the

housing market (despite the hope of 20-year homebuilder sentiment).

Cracks are already starting to appear in many metro areas across the

country, as a more profound slowdown could

be imminent.

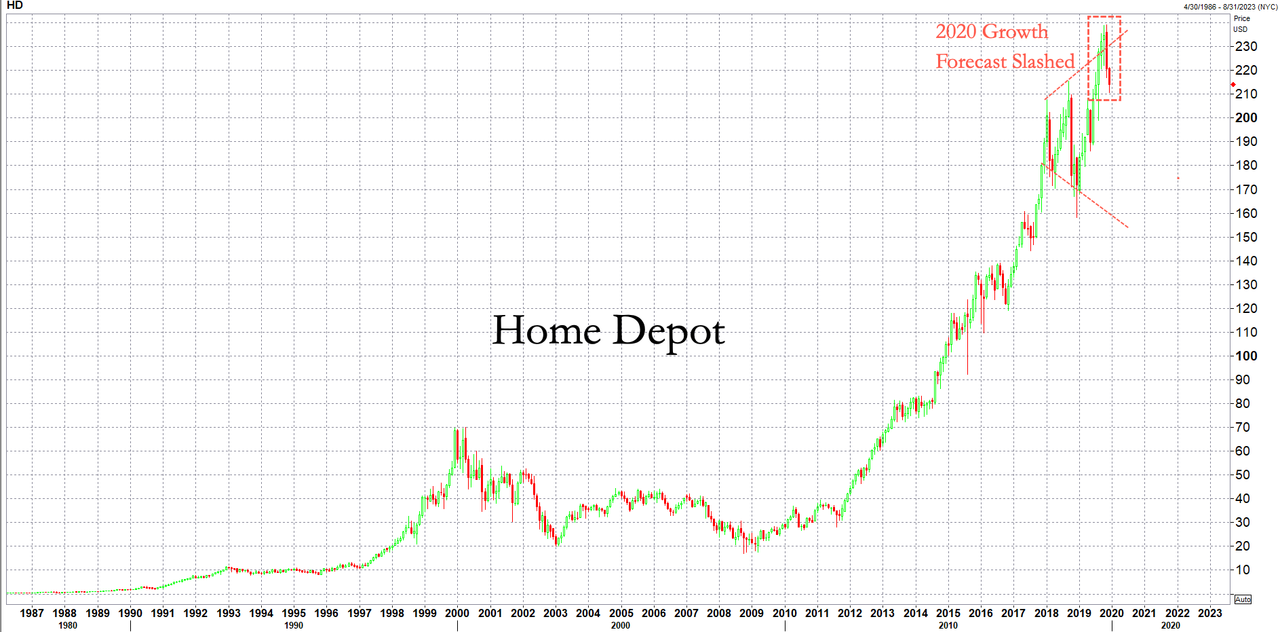

Last week, Home Depot ruined the

party and pretty much declared that a housing boom in 2020 is

non-existent.

The home-improvement chain cut its

sales forecast for 2020, signaling that real estate and consumers

could exhibit weakness in the year ahead.

The disappointing 2020 forecast

comes amid a report that 50 housing markets across the country are

already showing signs of a downturn.

GOBankingRates evaluated

500 metro areas for high rates of foreclosures and underwater

mortgages, variations in median home listing prices, the number of

days homes are on the market, and the percentage of for-sale listings

with price cuts, against the national average and determined the 50

most at-risk metro areas that are already turning south.

GOBankingRates determined that

Peoria, Illinois, is the most at-risk metro area of seeing its

housing market implode. Florida had the highest amount of real estate

markets that were slowing. Here's the full list:

50. Fort Myers, Florida

- Median list price: $249,999

- 2-year price change: -1.4%

- Percentage of underwater

mortgages: 6.9%

- Foreclosures: 1 in every

1,921 homes

House prices are dropping in

this city in southwest Florida. While home prices nationwide have

climbed an average of 9.4% over the past two years, prices have

dropped 1.4% in Fort Myers over the same period. Plus, houses for

sale spend 105 days on the market in Fort Myers, on average, compared

with a national average of 66 days.

49. Newport News, Virginia

- Median list price: $190,000

- 2-year price change: 8.4%

- Percentage of underwater

mortgages: 19.2%

- Foreclosures: 1 in every

2,172 homes

The percentage of underwater

mortgages in this city in southeastern Virginia near Virginia

Beach is more than double the national average of 8.2%. However, the

real estate market here hasn’t turned too ugly yet. In fact, the

percentage of listed home with price cuts in Newport News — 12.6% —

is lower than the national average of 17.5%.

48. Cumming, Georgia

- Median list price: $383,511

- 2-year price change: 1.2%

- Percentage of underwater

mortgages: 4%

- Foreclosures: 1 in every

2,311 homes

Home prices still are rising in

this suburb of Atlanta — but not nearly as much as the

national average. In fact, home prices in Cumming increased an

average of just 0.7% over the past year. And 21.8% of listed homes

here have seen price cuts compared with a national average of 17.5%.

47. Toledo, Ohio

- Median list price: $84,900

- 2-year price change: 8.8%

- Percentage of underwater

mortgages: 24.7%

- Foreclosures: 1 in every

1,428 homes

Home price growth has slowed

over the past year in this western Ohio city on the banks of Lake

Erie. However, the bigger problem here is the high percentage of

underwater mortgages — which is about three times the national

average. Plus, the number of foreclosed homes is higher than the

national average.

46. Naperville, Illinois

- Median list price: $439,990

- 2-year price change: -2.2%

- Percentage of underwater

mortgages: 6.5%

- Foreclosures: 1 in every

3,897 homes

This Chicago suburb has made it

onto plenty of “best places to live” lists. However, the housing

market has been slumping here. Home prices have dropped more than 2%

over the past two years. And at 26.4%, Naperville has the highest

percentage of listed homes with prices cuts of any city on this list.

45. Sarasota, Florida

- Median list price: $359,000

- 2-year price change: 5.6%

- Percentage of underwater

mortgages: 4.5%

- Foreclosures: 1 in every

1,520 homes

South of Tampa on Florida’s

Gulf Coast, Sarasota has a real estate market that could turn ugly.

Home price growth has slowed. Houses for sale are sitting on the

market for an average of 99 days, far longer than the national

average of 66 days. On top of that, the foreclosure rate is higher in

Sarasota than it is nationwide.

44. Fort Lauderdale, Florida

- Median list price: $499,900

- 2-year price change: -0.2%

- Percentage of underwater

mortgages: 7%

- Foreclosures: 1 in every

1,507 homes

The current housing market is

slumping in this tourist destination about 30 miles north of Miami.

Home prices in Fort Lauderdale have fallen in the past two years. And

the average number of days houses stay on the market here — 133 —

is double the national average.

43. Menifee, California

- Median list price: $380,000

- 2-year price change: 8.3%

- Percentage of underwater

mortgages: 5.5%

- Foreclosures: 1 in every

808 homes

This city in Southern

California is part of the Los Angeles metro area. The median home

price in Menifee is well above the national median. However, the

housing market here could be headed for trouble. Menifee has the

third-highest foreclosure rate among cities on this list.

42. Tuscaloosa, Alabama

- Median list price: $207,988

- 2-year price change: 0%

- Percentage of underwater

mortgages: 11.7%

- Foreclosures: 1 in every

2,393 homes

Home to the University of

Alabama, Tuscaloosa has a higher percentage of homeowners with

negative equity than the nation as a whole. Nearly 12% of mortgages

are underwater here compared with about 8% nationwide. The

foreclosure rate also is slightly higher in Tuscaloosa than the

average across the U.S.

41. Wilmington, Delaware

- Median list price: $194,550

- 2-year price change: 0.5%

- Percentage of underwater

mortgages: 15%

- Foreclosures: 1 in every

1,218 homes

The percentage of foreclosed

properties in Delaware’s largest city is twice as high as the

national average. And the percentage of underwater mortgages in

Delaware is almost double the percentage nationwide.

40. Naples, Florida

- Median list price: $407,990

- 2-year price change: -8.8%

- Percentage of underwater

mortgages: 6%

- Foreclosures: 1 in every

2,515 homes

The housing market has been

slowing in this city on Florida’s Gulf Coast. While home prices

nationwide have climbed 9.4%, on average, over the past two years,

they’ve fallen 8.8% in Naples over the same period. And the average

number of days that homes are on the market here — 140 — is more

than double the national average.

39. West Palm Beach, Florida

- Median list price: $298,000

- 2-year price change: 1.4%

- Percentage of underwater

mortgages: 7.3%

- Foreclosures: 1 in every

1,297 homes

Although home prices have risen

slightly in West Palm Beach over the last two years, they’ve fallen

in the past year. In addition, houses for sale stay on the market in

this city north of Miami an average of 119 days compared with an

average of 66 days nationwide. The foreclosure rate here is also

higher than the national rate.

38. Waterbury, Connecticut

- Median list price: $125,000

- 2-year price change: 11.9%

- Percentage of underwater

mortgages: 29.4%

- Foreclosures: 1 in every

1,159 homes

Home prices have risen more in

this city 77 miles northeast of New York City over the past two

years than across the U.S. However, the housing market in Waterbury

could be in trouble. The percentage of underwater mortgages here is

higher than in any other city on this list.

37. Plainfield, Illinois

- Median list price: $284,450

- 2-year price change: 3.6%

- Percentage of underwater

mortgages: 7.7%

- Foreclosures: 1 in every

1,138 homes

Home prices have been rising in

this village 35 miles southwest of Chicago but not at the same pace

as the national average. More telltale signs, though, that the

housing market in Plainfield could be turning ugly are the relatively

high foreclosure rate and percentage of homes for sale with price

cuts. In fact, Plainfield has the second-highest percentage of listed

homes with price cuts at 25.3%.

36. Bakersfield, California

- Median list price: $276,400

- 2-year price change: 1.1%

- Percentage of underwater

mortgages: 11.8%

- Foreclosures: 1 in every

1,095 homes

Home price growth is slowing in

this agriculture hub in California’s Central Valley region.

However, foreclosures and underwater mortgages are even bigger

problems for Bakersfield’s real estate market. The rates for both

are higher than the national averages.

35. Jacksonville, Florida

- Median list price: $219,000

- 2-year price change: 11.8%

- Percentage of underwater

mortgages: 11.2%

- Foreclosures: 1 in every

814 homes

Home prices are rising at a

faster rate in Florida’s largest city, on average, than across the

U.S. But Jacksonville has one of the highest foreclosure rates of any

city on this list. The percentage of underwater mortgages in this

city on the Atlantic Coast also tops the national average.

34. Orlando, Florida

- Median list price: $289,000

- 2-year price change: 5.7%

- Percentage of underwater

mortgages: 6.6%

- Foreclosures: 1 in every

1,328 homes

The current housing market in

Orlando could use some Walt Disney World magic to keep it from

turning ugly. Home price growth in this tourist destination has been

slowing. And the percentage of listed homes with price cuts — 21.2%

— is higher than the national percentage. The foreclosure rate in

Orlando also is higher than the foreclosure rate nationwide.

33. McKinney, Texas

- Median list price: $379,243

- 2-year price change: -1.3%

- Percentage of underwater

mortgages: 4.3%

- Foreclosures: 1 in every

2,546 homes

Home prices have been falling

in this fast-growing city that is 30 miles north of Dallas. While

home prices have risen an average of 9.4% over the past two years

across America, prices have fallen 1.3% in McKinney. Plus, McKinney

has one of the highest percentages of listed homes with price cuts

among the cities on this list.

32. Summerville, South Carolina

- Median list price: $268,293

- 2-year price change: 4.9%

- Percentage of underwater

mortgages: 6.3%

- Foreclosures: 1 in every

1,279 homes

Houses for sale are lingering

on the market longer in Summerville than the national average — 72

days versus 66 days. The increase in home prices in this city 24

miles northwest of Charleston also is lagging behind the national

average. And the foreclosure rate in Summerville is twice as high as

the rate nationwide.

31. Annapolis, Maryland

- Median list price: $499,181

- 2-year price change: 0.7%

- Percentage of underwater

mortgages: 9.5%

- Foreclosures: 1 in every

3,964 homes

Although the foreclosure rate

in Annapolis is lower than the rate nationwide, the capital of

Maryland’s housing market is showing some signs of trouble. Home

price growth has slowed over the past year. In fact, the city has a

higher percentage of listed homes with price cuts than the percentage

nationwide. And houses are staying on the market 14 days longer than

the U.S. average.

30. Stamford, Connecticut

- Median list price: $569,950

- 2-year price change: 3.5%

- Percentage of underwater

mortgages: 11.1%

- Foreclosures: 1 in every

4,498 homes

The housing market is slowing

in this city about 30 miles from New York. Home prices haven’t

risen over the past year, and houses for sale are staying on the

market longer than the U.S. average. Plus, the percentage of

mortgages underwater in Stamford is higher than the percentage

nationwide.

29. Champaign, Illinois

- Median list price: $164,900

- 2-year price change: 3.2%

- Percentage of underwater

mortgages: 11%

- Foreclosures: 1 in every

2,173 homes

The housing market in this city

that is home to the University of Illinois is showing signs of

weakness. The growth in home prices has been slowing. Houses spend

more days on the market in Champaign than they do nationwide. And

both the foreclosure rate and percentage of homes underwater are

higher than the national rates.

28. Port Saint Lucie, Florida

- Median list price: $247,280

- 2-year price change: 7.6%

- Percentage of underwater

mortgages: 6.2%

- Foreclosures: 1 in every

1,171 homes

Although the percentage of

underwater mortgages is below the national average in this city

that’s halfway between Miami and Orlando, the foreclosure rate is

twice as high. Plus, home price growth has slowed in Port Saint

Lucie.

27. Bradenton, Florida

- Median list price: $293,700

- 2-year price change: 1.7%

- Percentage of underwater

mortgages: 6.6%

- Foreclosures: 1 in every

1,799 homes

The housing market is slowing

more in Bradenton than in neighboring Sarasota. Home prices have

fallen 0.3% over the past year. And 21% of listed homes have price

cuts compared with 19.8% in Sarasota and 17.5% nationwide.

26. Ocala, Florida

- Median list price: $181,900

- 2-year price change: 8.9%

- Percentage of underwater

mortgages: 10.3%

- Foreclosures: 1 in every

972 homes

The foreclosure rate in this

city in north-central Florida is among the top 10 highest on this

list. Plus, the percentage of underwater mortgages in Ocala is higher

than the U.S. average. To top it off, home price growth has slowed

over the past year.

25. Dayton, Ohio

- Median list price: $67,000

- 2-year price change: 16.5%

- Percentage of underwater

mortgages: 27.6%

- Foreclosures: 1 in every

1,820 homes

The big increase in home prices

in Dayton over the past two years might signal to some that the real

estate market in this southwestern Ohio city is doing just fine.

However, Dayton has the second-highest percentage of underwater

mortgages among the cities on this list. And the foreclosure rate is

higher here than the national rate.

24. Lehigh Acres, Florida

- Median list price: $180,000

- 2-year price change: 6.5%

- Percentage of underwater

mortgages: 6.9%

- Foreclosures: 1 in every

1,189 homes

Although the percentage of

underwater mortgages in Lehigh Acres is lower than the percentage

nationwide, the foreclosure rate is higher here than the U.S.

average. In addition, this city in the Fort Myers metro area on

Florida’s Gulf Coast has seen a slowdown in home price growth

over the past year. Twenty percent of homes listed for sale here have

had price cuts.

23. Rockford, Illinois

- Median list price: $100,00

- 2-year price change: 10.5%

- Percentage of underwater

mortgages: 21%

- Foreclosures: 1 in every

890 homes

Rockford’s real estate market

could turn ugly because a significant percentage of homeowners here

have negative equity. More than 20% of mortgages are underwater in

this northern Illinois city compared with about 8% nationally. Plus,

the foreclosure rate in Rockford is one of the highest among cities

on this list.

22. Mobile, Alabama

- Median list price: $159,900

- 2-year price change: 6.3%

- Percentage of underwater

mortgages: 16.1%

- Foreclosures: 1 in every

2,149 homes

Home prices are still rising in

this port city on the Gulf Coast, but not as fast as prices are

increasing across the U.S. However, the bigger problem for Mobile’s

real estate market is homeowners with negative equity. The percentage

of underwater mortgages here is twice the national average.

21. Cape Coral, Florida

- Median list price: $262,200

- 2-year price change: 4.2%

- Percentage of underwater

mortgages: 5.5%

- Foreclosures: 1 in every

1,191 homes

This city near Fort Myers has

seen rapid growth, but its current housing market is experiencing a

slowdown. Home prices increased just 0.1%, on average, over the past

year. Nearly 22% of homes listed for sale have price cuts. And houses

in Cape Coral stay on the market an average of 103 days compared with

a national average of 66 days.

20. Fort Pierce, Florida

- Median list price: $199,900

- 2-year price change: 0.5%

- Percentage of underwater

mortgages: 9.7%

- Foreclosures: 1 in every

1,585 homes

While home prices climbed more

than 9% nationwide over the past two years, they barely budged in

this small city on Florida’s Atlantic Coast. Nearly 10% of

mortgages are underwater in Fort Pierce compared with about 8%

nationwide. And the foreclosure rate is higher than the rate across

the U.S.

19. Suffolk, Virginia

- Median list price: $282,785

- 2-year price change: 0%

- Percentage of underwater

mortgages: 14.8%

- Foreclosures: 1 in every

1,846 homes

Home prices haven’t risen

any, on average, over the past two years in Suffolk. And homes for

sale stay on the market an average of 76 days compared with a

national average of 66 days. The other problems the real estate

market is facing in this city — which is part of the Virginia

Beach metro area — are the relatively high percentage of underwater

mortgages and high foreclosure rate.

18. Laurel, Maryland

- Median list price: $350,000

- 2-year price change: -2.8%

- Percentage of underwater

mortgages: 12.6%

- Foreclosures: 1 in every

1,457 homes

Home prices have been falling

in this city that’s located between Baltimore and Washington,

D.C. On top of that, nearly 13% of mortgages are underwater in

Laurel compared with about 8% nationwide. And the foreclosure rate is

higher than the U.S. average.

17. Joliet, Illinois

- Median list price: $169,900

- 2-year price change: 9.6%

- Percentage of underwater

mortgages: 15.5%

- Foreclosures: 1 in every

812 homes

Although home prices in Joliet

increased 9.6% over the past two years, prices haven’t risen any,

on average, over the past year. What’s more troubling, though, are

the high number of foreclosures and underwater mortgages in this city

30 miles southwest of Chicago. Joliet has the fourth-highest

foreclosure rate among cities on this list. And the percentage of

underwater mortgages here is almost double the percentage nationwide.

16. Valdosta, Georgia

- Median list price: $154,900

- 2-year price change: 0%

- Percentage of underwater

mortgages: 22.7%

- Foreclosures: 1 in every

3,304 homes

The foreclosure rate in this

city near the Georgia-Florida border is lower than the U.S.

average. However, Valdosta has one of the highest percentages of

underwater mortgages among cities on this list. Home prices here have

also fallen more than 6% over the past year.

15. Decatur, Illinois

- Median list price: $99,900

- 2-year price change: 8.5%

- Percentage of underwater

mortgages: 20.4%

- Foreclosures: 1 in every

5,785 homes

Decatur has the lowest

foreclosure rate among the cities on this list. But the housing

market in this central Illinois city could turn ugly due to its high

percentage of underwater mortgages. Decatur also has a higher

percentage of homes with price cuts than half of the cities on this

list, and homes for sale spend more days on the market here than in a

majority of cities.

14. Elgin, Illinois

- Median list price: $240,000

- 2-year price change: 7.8%

- Percentage of underwater

mortgages: 11.9%

- Foreclosures: 1 in every

1,223 homes

The foreclosure rate in this

Chicago suburb is twice the national rate. Plus, home price

growth in Elgin has slowed over the past year, and nearly 20% of

homes listed for sale have had price cuts.

13. Riverview, Florida

- Median list price: $252,990

- 2-year price change: 2.2%

- Percentage of underwater

mortgages: 7.2%

- Foreclosures: 1 in every

796 homes

Like other cities in the Tampa

area, Riverview has a housing market that could turn ugly. It has the

second-highest foreclosure rate on this list. Home price growth has

slowed over the past year. And nearly 25% of homes listed for sale

have had price cuts compared with 17.5% nationwide.

12. Atlanta

- Median list price: $339,500

- 2-year price change: 1.6%

- Percentage of underwater

mortgages: 8.8%

- Foreclosures: 1 in every

1,942 homes

Home prices have dropped 3%

over the past year in Georgia’s capital and largest city. Atlanta

is also seeing homes stay on the market longer than the U.S. average.

Plus, the foreclosure rate here is higher than the rate nationwide.

11. Lawton, Oklahoma

- Median list price: $99,900

- 2-year price change: 5%

- Percentage of underwater

mortgages: 25.7%

- Foreclosures: 1 in every

1,661 homes

Lawton has the fourth-highest

percentage of underwater mortgages among cities on this list. The

foreclosure rate also is higher in this southwestern Oklahoma city

than it is nationwide. And homes stay on the market an average of 117

days compared with a U.S. average of 66 days.

10. Hampton, Virginia

- Median list price: $182,000

- 2-year price change: 4.8%

- Percentage of underwater

mortgages: 19.9%

- Foreclosures: 1 in every

2,148 homes

Hampton is one of the

fastest-growing cities in the Hampton Roads region on the Chesapeake

Bay. However, it’s housing market has been slowing. Home prices

have fallen nearly 3%, on average, over the past year. And the

percentage of underwater mortgages here is double the percentage

nationwide.

9. Aurora, Illinois

- Median list price: $220,000

- 2-year price change: 4.7%

- Percentage of underwater

mortgages: 11.8%

- Foreclosures: 1 in every

1,491 homes

This Chicago suburb is actually

the second-largest city in Illinois. Its current housing market is

showing signs of trouble, though. Aurora has the fourth-highest

percentage of homes with price cuts at 23.7%. And the foreclosure

rate and percentage of underwater mortgages are higher than the U.S.

averages.

========================================

* Zie: 'Belastingschijven onrecht: Rutte 3 knijpt de onderlaag verder af met verhoging belastingtarief, terwijl de welgestelden een belastingverlaging krijgen' (en zie de reacties onder dat bericht)

Geen opmerkingen:

Een reactie posten